Among all of the other holiday tasks and resolutions likely still on your to-do list, if you are an entrepreneur looking to raise capital in 2013 and hope to take advantage of the Minnesota Angel Tax Credit, you should think about starting the process now. The state’s annual allotment of credits, which gives qualifying investors up to a 25% tax credit on eligible investments in Minnesota start-up businesses, has seen a trend of depletion earlier and earlier in each year of its existence. The first full year’s allotment of $16 million in 2011 was fully subscribed for by November of that year. 2012’s allotment of $12 million was exhausted by the end of July, in part due to a last-minute rush on the credits precipitated by articles reporting on the scarcity of credits. So, if word on the street is any indicator, the additional $12 million allotment for 2013 will be gone even earlier this year.

The credits have proven to be deserving of their status as a “hot commodity.” Between July of 2010 (when the program started) and the end of 2011, the credits helped generate $92 million in investments in Minnesota companies, and that number reached $140 million after the 2012 allotment. Over 100 companies were issued the credits in 2012 (a few of which, we are proud to say, are Gray Plant Mooty clients.) The program is currently only set to last through 2014, with the same amount of funding in its final year as in 2012 and 2013.

So what should you do to make sure you get your share of the tax credits this year? Minnesota’s Department of Employment and Economic Development (DEED) is already accepting applications for business certification, which solidifies a business’s qualification to receive applicable investors in the coming year. Investors may also currently submit their certification applications to obtain qualified investor status. These forms and other directions can be found on the DEED website. You will still have to wait until 2013 to officially begin a joint filing between the business and the investors of the specific credit allocation application (and, of course, the making of the actual investment). With businesses and investors already poised to file for allocations and transfer money, I can only imagine that the DEED office is gearing up for a busy start to the new year next week!

A Post by Karen Wenzel, Guest Blogger

Monday, December 31, 2012

Get In Line for 2013 Minnesota Angel Tax Credits

Labels:

Angel Tax Credit

,

entrepreneurialism

,

Guest Author

,

Karen Wenzel

,

Taxes

Thursday, December 20, 2012

2012 Gifting—When is a gift actually complete?

Many clients are doing year-end gifting this year. We have an unusually large gift tax exemption and thus the additional ability to gift without tax implications, and we are facing unknown tax laws going forward. You may or may not be gifting assets, or receiving assets by gift, but I thought this might be a good opportunity (albeit boring—unless you are receiving a large gift this year) to discuss what it means to actually complete the gift by the end of 2012.

• Cash and checks—a gift of cash or checks is complete when the transfer of funds is complete or when the check is cashed.

• Real estate—a deed (warranty deed or quitclaim deed) is necessary to transfer the property. The gift is complete when the deed is delivered to the recipient or recorded in the appropriate county.

• Stock in a company—a decision to make the gift, or even a letter, is not sufficient. There must be an Assignment Separate from Certificate with the stock certificate, or an endorsed stock certificate, to complete the gift of stock. The gift is complete when the assignment or endorsed certificate is delivered to the recipient or an agent of the recipient, but not if it is merely delivered to the agent of the person making the gift. The agent of the recipient could be a transfer agent, but often either (1) there is no such thing for a closely held company, or (2) that transfer agent is considered an agent of the person gifting and not the recipient. The other way to determine if the gift is complete is if the transfer is recorded in the company records. Be sure to check buy-sell agreements or other documents for transfer restrictions. If a transfer is done in violation of any such restrictions, it could be considered void even if it is otherwise complete.

• LLC’s/Partnerships—as is the case with the transfer of corporate stock, an assignment with an acceptance from the recipient will complete the transfer of interests in an LLC or partnership. The gift is complete when control is transferred to the recipient. Again, consult the transfer restrictions or requirements applicable to new members in the company’s documents to be sure you comply with those requirements as well.

In addition to completing the steps outlined above, it is important after the fact to treat the asset that has been given as a gift as having been transferred. For real estate, it is important to treat property as if the new owners have complete control. Change the insurance, execute a lease to use the property, change the property tax information. With stock or interests in LLC’s and partnerships, the company records should reflect the change, distributions should go to the new owners, any guaranties should be negotiated, new members should be added to the buy-sell or other corporate documents, and K-1’s should be prepared for the new owners. Also, report these gifts on a gift tax return. If you are gifting in 2012, or really any year, be sure to meet the reporting requirements with the IRS and have your attorney or accountant prepare a gift tax return in April of 2013.

• Cash and checks—a gift of cash or checks is complete when the transfer of funds is complete or when the check is cashed.

• Real estate—a deed (warranty deed or quitclaim deed) is necessary to transfer the property. The gift is complete when the deed is delivered to the recipient or recorded in the appropriate county.

• Stock in a company—a decision to make the gift, or even a letter, is not sufficient. There must be an Assignment Separate from Certificate with the stock certificate, or an endorsed stock certificate, to complete the gift of stock. The gift is complete when the assignment or endorsed certificate is delivered to the recipient or an agent of the recipient, but not if it is merely delivered to the agent of the person making the gift. The agent of the recipient could be a transfer agent, but often either (1) there is no such thing for a closely held company, or (2) that transfer agent is considered an agent of the person gifting and not the recipient. The other way to determine if the gift is complete is if the transfer is recorded in the company records. Be sure to check buy-sell agreements or other documents for transfer restrictions. If a transfer is done in violation of any such restrictions, it could be considered void even if it is otherwise complete.

• LLC’s/Partnerships—as is the case with the transfer of corporate stock, an assignment with an acceptance from the recipient will complete the transfer of interests in an LLC or partnership. The gift is complete when control is transferred to the recipient. Again, consult the transfer restrictions or requirements applicable to new members in the company’s documents to be sure you comply with those requirements as well.

In addition to completing the steps outlined above, it is important after the fact to treat the asset that has been given as a gift as having been transferred. For real estate, it is important to treat property as if the new owners have complete control. Change the insurance, execute a lease to use the property, change the property tax information. With stock or interests in LLC’s and partnerships, the company records should reflect the change, distributions should go to the new owners, any guaranties should be negotiated, new members should be added to the buy-sell or other corporate documents, and K-1’s should be prepared for the new owners. Also, report these gifts on a gift tax return. If you are gifting in 2012, or really any year, be sure to meet the reporting requirements with the IRS and have your attorney or accountant prepare a gift tax return in April of 2013.

Labels:

Anne Bjerken

,

Estate Planning

,

Family Business

,

Taxes

Tuesday, December 18, 2012

The Hobbit: An Unexpected Journey in Trademark Disputes

The movie “The Hobbit: An Unexpected Journey” opened this last weekend, apparently setting a new attendance record for the month of December.

Only last week, the movie’s producers successfully stopped the release of the movie “Age of the Hobbits,” a “mockbuster” film produced by The Global Asylum, Inc. (producers of such other films as “Transmorphers,” “Snakes on a Train” and “Titanic 2”). Warner Brothers Entertainment, New Line Cinema, Metro-Goldwyn-Mayer Studios and The Saul Zaentz Company, owners of the exclusive rights to produce and distribute films based on The Hobbit and The Lord of the Rings novels by J.R.R. Tolkien, sued Global Asylum for trademark infringement, false designation of origin, trademark dilution, false advertising and unfair competition. (The Saul Zaentz Company also owns several trademark registrations for HOBBIT and the individual movie titles in the intended Hobbit series).

One could certainly understand the producer’s concern given the scheduled release of “Age of the Hobbits” only a few days before “The Hobbit” – except that the Global Asylum movie was being released straight to video, and the cover material stated “they’re not Tolkien’s hobbits…they’re real” and identified its stars as “Bai Ling” and “a guy from Stargate SG-1.”

I remember a friend telling of a “ruined” girls’ movie night when the participant responsible for the movies picked up the Charles Bronson action movie “Murphy’s Law” instead of the intended romantic film “Murphy’s Romance” with James Garner and Sally Field. Yes, the person made a mistake based on the titles of the respective movies. Being personally unfamiliar with the movie, she had requested help at the video store and accepted the clerk’s interpretation of her rather garbled description. Those who had suggested the movie, however, knew immediately that the wrong movie had been selected, and even the person making the mistake acknowledged that she should have known by looking at the DVD cover. While there was confusion in the selection of the movie, there was never any confusion about the movies themselves or their respective “sources”.

If I sound a little annoyed with the plaintiffs in this matter, you should know that only a few years ago, my partner Norm Abramson also journeyed to “Middle Earth” in the defense of a trademark infringement claim by Saul Zaentz relating to the HOBBIT mark.

The lawsuit was brought in 2006 against Hobbit Travel, which at the time, had been in business for 30 years. Hobbit Travel’s substantial business and significant marketing and promotion were strong evidence of constructive knowledge of the plaintiffs’ awareness of the company, and the plaintiffs’ own search reports showed actual knowledge of Hobbit Travels’ use of the mark since 1984. The suit was eventually dismissed on the basis of laches, an equitable defense based on the plaintiff’s failure to timely object to Hobbit Travel’s use of its name. In a more succinct explanation of laches, the trial judge asked Saul Zaentz in the oral argument if it had “been sleeping under a rock” with regard to Hobbit Travel. Unfortunately, this result was achieved only after a lengthy and costly battle in response to the plaintiff’s scorched earth approach.

Admittedly the current case is very different – it is, after all, about a film vs. a film. There are, no doubt, many legitimate concerns in this instance. In my view, however, the plaintiffs have hurt their credibility by having targeted anyone using “hobbit.” Had they been more reasonable in their prior challenges regarding Hobbit Travel and others, it might be easier to take the current case more seriously. As it is, I wonder about their faith in their own brand if they are that concerned that this low-budget film about cannibals (no, the hobbits are not the cannibals, they are the meal) will really be confused with the plaintiffs’ other productions.

Although a hearing is set for January 28, 2013 to determine whether the restraining order will be converted to a preliminary injunction, lots can happen in the meantime. Already, there has been an announcement that “Age of the Hobbits” may have a theatrical release in Cambodia (where it was filmed) under a different title. But don’t count out Global Asylum. The mockbuster is its bread and butter, and they have successfully defended claims similar to those being leveled against them in connection with “Age of the Hobbits.” It is possible that the action between Warner Bros. and Global Asylum may be more interesting than either movie.

Only last week, the movie’s producers successfully stopped the release of the movie “Age of the Hobbits,” a “mockbuster” film produced by The Global Asylum, Inc. (producers of such other films as “Transmorphers,” “Snakes on a Train” and “Titanic 2”). Warner Brothers Entertainment, New Line Cinema, Metro-Goldwyn-Mayer Studios and The Saul Zaentz Company, owners of the exclusive rights to produce and distribute films based on The Hobbit and The Lord of the Rings novels by J.R.R. Tolkien, sued Global Asylum for trademark infringement, false designation of origin, trademark dilution, false advertising and unfair competition. (The Saul Zaentz Company also owns several trademark registrations for HOBBIT and the individual movie titles in the intended Hobbit series).

One could certainly understand the producer’s concern given the scheduled release of “Age of the Hobbits” only a few days before “The Hobbit” – except that the Global Asylum movie was being released straight to video, and the cover material stated “they’re not Tolkien’s hobbits…they’re real” and identified its stars as “Bai Ling” and “a guy from Stargate SG-1.”

I remember a friend telling of a “ruined” girls’ movie night when the participant responsible for the movies picked up the Charles Bronson action movie “Murphy’s Law” instead of the intended romantic film “Murphy’s Romance” with James Garner and Sally Field. Yes, the person made a mistake based on the titles of the respective movies. Being personally unfamiliar with the movie, she had requested help at the video store and accepted the clerk’s interpretation of her rather garbled description. Those who had suggested the movie, however, knew immediately that the wrong movie had been selected, and even the person making the mistake acknowledged that she should have known by looking at the DVD cover. While there was confusion in the selection of the movie, there was never any confusion about the movies themselves or their respective “sources”.

If I sound a little annoyed with the plaintiffs in this matter, you should know that only a few years ago, my partner Norm Abramson also journeyed to “Middle Earth” in the defense of a trademark infringement claim by Saul Zaentz relating to the HOBBIT mark.

The lawsuit was brought in 2006 against Hobbit Travel, which at the time, had been in business for 30 years. Hobbit Travel’s substantial business and significant marketing and promotion were strong evidence of constructive knowledge of the plaintiffs’ awareness of the company, and the plaintiffs’ own search reports showed actual knowledge of Hobbit Travels’ use of the mark since 1984. The suit was eventually dismissed on the basis of laches, an equitable defense based on the plaintiff’s failure to timely object to Hobbit Travel’s use of its name. In a more succinct explanation of laches, the trial judge asked Saul Zaentz in the oral argument if it had “been sleeping under a rock” with regard to Hobbit Travel. Unfortunately, this result was achieved only after a lengthy and costly battle in response to the plaintiff’s scorched earth approach.

Admittedly the current case is very different – it is, after all, about a film vs. a film. There are, no doubt, many legitimate concerns in this instance. In my view, however, the plaintiffs have hurt their credibility by having targeted anyone using “hobbit.” Had they been more reasonable in their prior challenges regarding Hobbit Travel and others, it might be easier to take the current case more seriously. As it is, I wonder about their faith in their own brand if they are that concerned that this low-budget film about cannibals (no, the hobbits are not the cannibals, they are the meal) will really be confused with the plaintiffs’ other productions.

Although a hearing is set for January 28, 2013 to determine whether the restraining order will be converted to a preliminary injunction, lots can happen in the meantime. Already, there has been an announcement that “Age of the Hobbits” may have a theatrical release in Cambodia (where it was filmed) under a different title. But don’t count out Global Asylum. The mockbuster is its bread and butter, and they have successfully defended claims similar to those being leveled against them in connection with “Age of the Hobbits.” It is possible that the action between Warner Bros. and Global Asylum may be more interesting than either movie.

Labels:

Entertainment

,

Intellectual Property

,

Lori Wiese-Parks

,

Marketing

Thursday, December 13, 2012

Santa Claus… you’re fired.

Not too long ago, Santa Claus was reduced to mortality in our house with some of the “older children.” Trust me when I admit that preparing for it was much worse than doing the deed itself. I had a flash of creativity about alternative ways to deal with his demise—eggnog poisoning, Rudolph crashing after being beamed with a red laser (ironic), elf sabotage, inaccessibility to healthcare in the North Pole and St. Nick falling through the Medicare donut hole, Grandpa and cousin Mel ordering a gang-style revenge killing for Grandma getting run over by a reindeer... My daughter, the sensitive one, took the news better than I thought until she tabulated the list of improbable beliefs that she has clung to for years (E. Bunny—gone; tooth fairy—vaporized; leprechauns; the 2013 NHL Season; and so on…) My more pragmatic son kept muttering under his breath, “ I knew it—we don’t even have a chimney….”

In the spirit of keeping it seasonally “light,” I’ll move away from Santa Claus’s demise to something I picked up from catching a few minutes of Fred Claus while trying to be productive doing something else. In Fred Claus, the antagonist, Clyde Northcutt (played by Kevin Spacey), is a corporate efficiency expert who has been deployed by shareholders to the North Pole to investigate concerns that things “up north” aren’t being run properly. SPOILER ALERT: Spacey’s character reveals that while things in the North Pole are running “just fine,” there are legitimate shareholder concerns about efficiency and profitability that ultimately lead to Santa being fired (with a little help from Santa’s brother Fred.)

What makes any movie a classic is characters that resonate with an audience and communicate an element of at least one moral truth or lesson. In Fred Claus, that lesson is that external and internal forces can foul up an otherwise effective organization, even the global operation led successfully by the iconic and immortal S. Claus for hundreds of years.

This year, perhaps more than any other in recent memory, has highlighted the resiliency of companies of all sizes to adapt, pivot, and change in the face of remarkable external market, political and global forces: changes in healthcare policy, changes in tax rates, changes in tax policy, uncertainty in the markets, global currency stress, flagging of the EU, new medical device taxes, user fees, superstorms, banking regulations, changes in regulation, a mind-numbing election cycle, the fiscal cliff, and—for the love of humanity—the demise of Hostess. Yet the one thing that stands out is that the business owners, the entrepreneurs, the managers, the staff and the leaders—individuals who really make up the companies that we all depend on—continue to find creative ways to stay in business and remain viable and engaged.

Yes, unemployment and underemployment are still issues and the aforementioned factors affecting businesses are real problems, but business owners will find a way to persevere just as they always have. Will layoffs continue as companies seek to find new ways to be efficient? Yes. This always happens and, despite the human costs, the indomitable American spirit keeps people coming back, finding new jobs, starting new companies and finding ways to succeed. Consumer confidence may wane, but business owner confidence has remained, even if at a lower level than in prior years.

According to a recent USA Today story, “The NFIB survey of business confidence fell almost six points to 87.5, the lowest score since 2009 and far below stock market expectations for 92.5. The drop is a sign that business owners are losing confidence...” Is this a concern? Certainly, but the day to start worrying is when business owners decide, “it’s not worth it anymore”—in other words, when we approach an “enthusiasm cliff” as opposed to a “fiscal cliff.” Let’s hope that 2013 ushers in greater confidence in all sectors of the economy. Otherwise, maybe 2013 will be the year when Santa is

Tuesday, December 11, 2012

The Book: John “the Penguin” Bingham, An Accidental Athlete: A Funny Thing Happened on the Way to Middle Age (VeloPress, 2011).

Why: An example of how an entrepreneurial mindset can take a simple idea and turn it into a thriving business.

Back at the turn of the century (this century, not the last—I’m not that old, despite how I may feel on decidedly wintery mornings such as this), I decided that I needed to run a marathon. Why? I can only now speculate. I suspect this may have been my mid-life crisis. I think I thought I should make use of the old machinery to achieve something that, at least personally, seemed notable.

I had been a runner—no, scratch that, let’s say a jogger—for most of my life, starting in my high school years when long runs came with the territory when training to secure my third-string place on the school soccer team. Turns out I liked the running better, and was far more skilled at it than at the game, though indeed this is not saying much. So, ramping up to run really long distances just meant more (read “longer,” as in distance and time commitment) of what I had been doing for years.

For all those long runs, and all the time I clocked sweating profusely and putting one foot in front of the other on local streets and trails, I never once wondered if I could turn what I was doing into a business opportunity. This, sadly, is what separates me from John Bingham, author of a number of books for “adult-onset” athletes, who has now written a memoir of sorts under the title, An Accidental Athlete: A Funny Thing Happened on the Way to Middle Age.

Bingham is actually quite well known to long-time readers of Runner’s World as the columnist who for years wrote in that magazine under the pen name “the Penguin.” Apparently, during his long runs, Bingham actually thought about what he was doing, why he was doing it, and made the connection that, as a baby boomer, there were probably a lot of people like him who were thinking and doing the same thing. The result: a steady gig as a columnist for a popular running magazine, leading to a number of successful books aimed at this demographic group, leading to a successful business organizing trips to exotic locales for long distance runs.

It only goes to confirm, in my mind, that any endeavor can serve as the basis for a solid entrepreneurial idea. Take a simple idea and some shrewd insight, and add in a whole lot of passion, and you can achieve great things.

What about me? Well, since you asked, yes, I finished not one, but two marathons, and no, I don’t think I feel the need to do another one. But every time I go for a jog I wonder, “How come Bingham had this idea but I didn’t?” I choose to think my big idea has not yet occurred to me, and I’m sticking with that for now.

Back at the turn of the century (this century, not the last—I’m not that old, despite how I may feel on decidedly wintery mornings such as this), I decided that I needed to run a marathon. Why? I can only now speculate. I suspect this may have been my mid-life crisis. I think I thought I should make use of the old machinery to achieve something that, at least personally, seemed notable.

I had been a runner—no, scratch that, let’s say a jogger—for most of my life, starting in my high school years when long runs came with the territory when training to secure my third-string place on the school soccer team. Turns out I liked the running better, and was far more skilled at it than at the game, though indeed this is not saying much. So, ramping up to run really long distances just meant more (read “longer,” as in distance and time commitment) of what I had been doing for years.

For all those long runs, and all the time I clocked sweating profusely and putting one foot in front of the other on local streets and trails, I never once wondered if I could turn what I was doing into a business opportunity. This, sadly, is what separates me from John Bingham, author of a number of books for “adult-onset” athletes, who has now written a memoir of sorts under the title, An Accidental Athlete: A Funny Thing Happened on the Way to Middle Age.

Bingham is actually quite well known to long-time readers of Runner’s World as the columnist who for years wrote in that magazine under the pen name “the Penguin.” Apparently, during his long runs, Bingham actually thought about what he was doing, why he was doing it, and made the connection that, as a baby boomer, there were probably a lot of people like him who were thinking and doing the same thing. The result: a steady gig as a columnist for a popular running magazine, leading to a number of successful books aimed at this demographic group, leading to a successful business organizing trips to exotic locales for long distance runs.

It only goes to confirm, in my mind, that any endeavor can serve as the basis for a solid entrepreneurial idea. Take a simple idea and some shrewd insight, and add in a whole lot of passion, and you can achieve great things.

What about me? Well, since you asked, yes, I finished not one, but two marathons, and no, I don’t think I feel the need to do another one. But every time I go for a jog I wonder, “How come Bingham had this idea but I didn’t?” I choose to think my big idea has not yet occurred to me, and I’m sticking with that for now.

Thursday, December 6, 2012

Featured Comic: Friends, Family & Fools 12/06/12

Labels:

Crowdfunding

,

Dan Tenenbaum

,

Friends Family and Fools

Monday, December 3, 2012

Facebook Furor and a Follow-up on Copyright Law

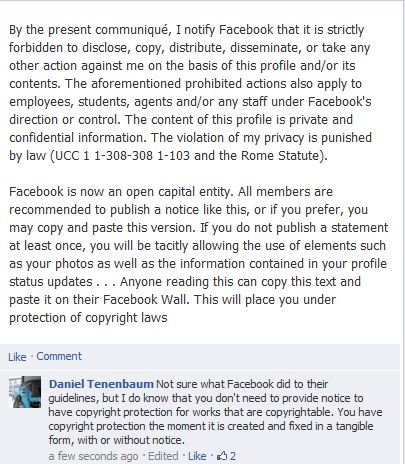

I recently wrote a post about United States copyright law, and how it applies to some classic Christmas carols. If you don’t like Christmas music (or even if you do), you may be still more interested in how copyright law has recently invaded your Facebook newsfeed. The below post showed up recently on the Facebook feed one of my fellow entreVIEW authors (and, as you’ll see, he couldn't help but provide a short response):

Like probably tens (or hundreds) of millions of others, I saw similar posts on my newsfeed. I assumed there was already some commentary “out there” about what this post actually means and accomplishes (which, by the way, is pretty much nothing), and that is in fact the case. Articles like “Quit Posting Facebook Copyright/Privacy Messages — It’s a Hoax,” and “Viral post won't copyright your Facebook updates” reference Facebook’s recent “Fact Check” statement that “Anyone who uses Facebook owns and controls the content and information they post, as stated in our terms.”

Users of websites, including Facebook, are usually required to consent to “Terms of Use” (of course, there’s been litigation about the enforceability of these “click through” agreements, but generally they are held to be enforceable.) As a result, if Facebook’s terms said something different your alternative would be to stop using Facebook—a thought that, for some, would be more difficult than giving up food or oxygen…

More fundamentally, however, it’s worth embellishing on Dan’s response related to the rules of copyright law. As noted in my previous post, copyright protection for “original works of authorship fixed in a tangible medium” applies to works like novels, movies, and songs. These types of works are automatically protected under copyright the moment they are created and fixed in a tangible medium. So, for example, if you come up with an idea for a novel, your idea is not protected. But if you start writing the idea down on paper (or more likely on your computer), your creative work automatically becomes copyright protected. No “communique” needed.

Don’t get me wrong – posting that new, special poem you wrote (or awkward family photo) as your next Facebook status certainly makes it easier for someone to use or steal it, but your own, personal copyright in that work will technically be protected under U.S. copyright law no matter what your other Facebook posts say.

A Post by Karen Wenzel, Guest Blogger

Labels:

Entertainment

,

Guest Author

,

Intellectual Property

,

Karen Wenzel

,

Social Media

Subscribe to:

Posts

(

Atom

)